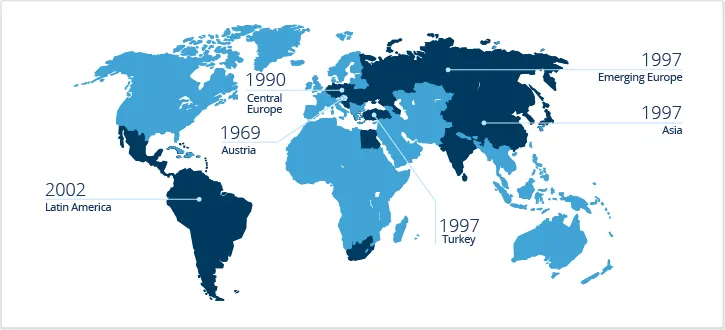

Emerging Markets

Strategies for European and global emerging markets.

Disclaimer and legal notes

ERSTE BOND EM CORPORATE

ERSTE BOND DANUBIA

ERSTE STOCK EM GLOBAL

Disclaimer

This document is an advertisement. Please refer to the prospectus of the UCITS or to the Information for Investors pursuant to Art 21 AIFMG of the alternative investment fund and the Key Information Document before making any final investment decisions. Unless indicated otherwise, source: Erste Asset Management GmbH. Our languages of communication are German and English.

The prospectus for UCITS (including any amendments) is published in accordance with the provisions of the InvFG 2011 in the currently amended version. Information for Investors pursuant to Art 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in connection with the InvFG 2011. The fund prospectus, Information for Investors pursuant to Art 21 AIFMG, and the Key Information Document can be viewed in their latest versions at the web site www.erste-am.com within the section mandatory publications or obtained in their latest versions free of charge from the domicile of the management company and the domicile of the custodian bank. The exact date of the most recent publication of the fund prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the Key Information Document are available, and any additional locations where the documents can be obtained can be viewed on the web site www.erste-am.com. A summary of investor rights is available in German and English on the website www.erste-am.com/investor-rights as well as at the domicile of the management company.

The management company can decide to revoke the arrangements it has made for the distribution of unit certificates abroad, taking into account the regulatory requirements.

Detailed information on the risks potentially associated with the investment can be found in the fund prospectus or Information for investors pursuant to Art 21 AIFMG of the respective fund. If the fund currency is a currency other than the investor's home currency, changes in the corresponding exchange rate may have a positive or negative impact on the value of his investment and the amount of the costs incurred in the fund - converted into his home currency.

Our analyses and conclusions are general in nature and do not take into account the individual needs of our investors in terms of earnings, taxation, and risk appetite. Past performance is not a reliable indicator of the future performance of a fund.